views

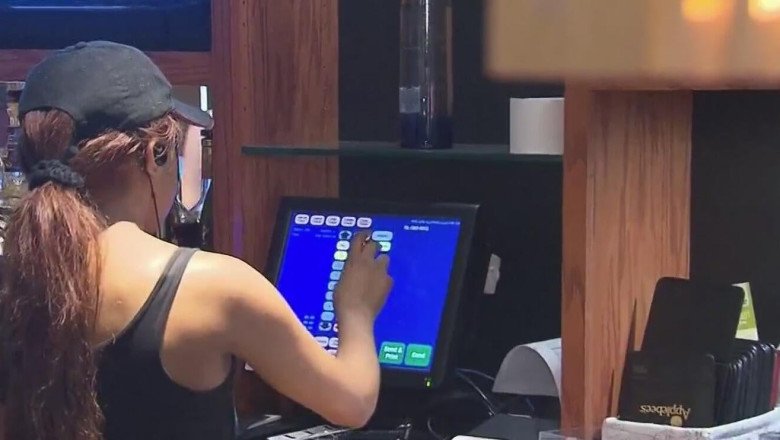

No tax on tips: What workers should know

No tax on tips: What workers should know

01:45

The Republican-backed fiscal package signed into law by President Trump on July 4 includes a temporary tax break that stands to benefit millions of Americans: a provision that allows eligible workers to avoid paying federal income tax on tips.

The “big, beautiful bill,” as the legislation was dubbed, tasked the Trump administration with publishing a list of occupations that qualify for the tax break within 90 days of the bill’s passage. Now, the Treasury Department has issued that list, which includes 68 occupations ranging from traditional tipped jobs like waiters to some that don’t typically invite gratuities, such as plumbers, electricians and air conditioning repairers.

The list, which was first reported by Axios, isn’t final, as it must still be published in the Federal Register. But the Treasury Department notes that the IRS expects the final list to “be substantially the same as this preliminary list.”

The new tax rule could save qualifying tipped workers about $1,300 each, according to the White House. Some restrictions built into the law could limit the tax break’s value, while some people in jobs on Treasury’s list — but that don’t typically receive tips — might not derive much benefit from the change.

“Those in the hospitality industry will be the big winners under this new policy,” noted law firm Fisher Phillips in a Sept. 2 blog post about the proposed list of covered occupations.

The Treasury Department and White House didn’t immediately respond to a request for comment.

First, a worker will only qualify for the tax break if their occupation is on Treasury’s list of jobs that qualify for “no tax on tips.”

The provision also contains other restrictions, including:

The Treasury Department has identified eight types of occupations in which workers could avoid taxes on their tips. The examples in the parentheses below are jobs listed by Treasury for each subcategory.

More from CBS News

Aimee Picchi is the associate managing editor for CBS MoneyWatch, where she covers business and personal finance. She previously worked at Bloomberg News and has written for national news outlets including USA Today and Consumer Reports.

https://wol.com/workers-in-68-occupations-may-soon-be-exempt-from-paying-taxes-on-tips-including-some-surprising-jobs/

Comments

0 comment