views

Suspense, fueled by deafening engine roars, filled the air at the motorcycle Grand Prix as riders whizzed through a sprawling beachside racetrack—a landmark that has sprung up in Mandalika, a coastal enclave on Indonesia’s Lombok island. As part of a campaign to create “new Balis” across the Southeast Asian nation, once sleepy fishing villages like Mandalika’s have over the last several years given way to swanky collections of chain hotels, beach bars, and world-class attractions like the Mandalika International Street Circuit.

But as over 100,000 spectators showed up for the now-annual three-day racing event in October, few were aware of a different tension pervading the same grounds: in the weeks leading up to the big event, authorities had descended upon communities living around the racetrack, allegedly destroying private property, restricting residents’ movement, and cracking down on those who dared to protest—the latest development in yearslong complaints of routine intimidation in the island’s dwindling hamlets.

Life hasn’t seemed much easier for those who have moved away. More than 60 households have been relocated to designated resettlement sites, far from the shore where their livelihoods once depended on fishing and farming seaweed, and with limited access to clean water and amenities. Around 60 other families are stranded in temporary shelters where they are vulnerable to further evictions.

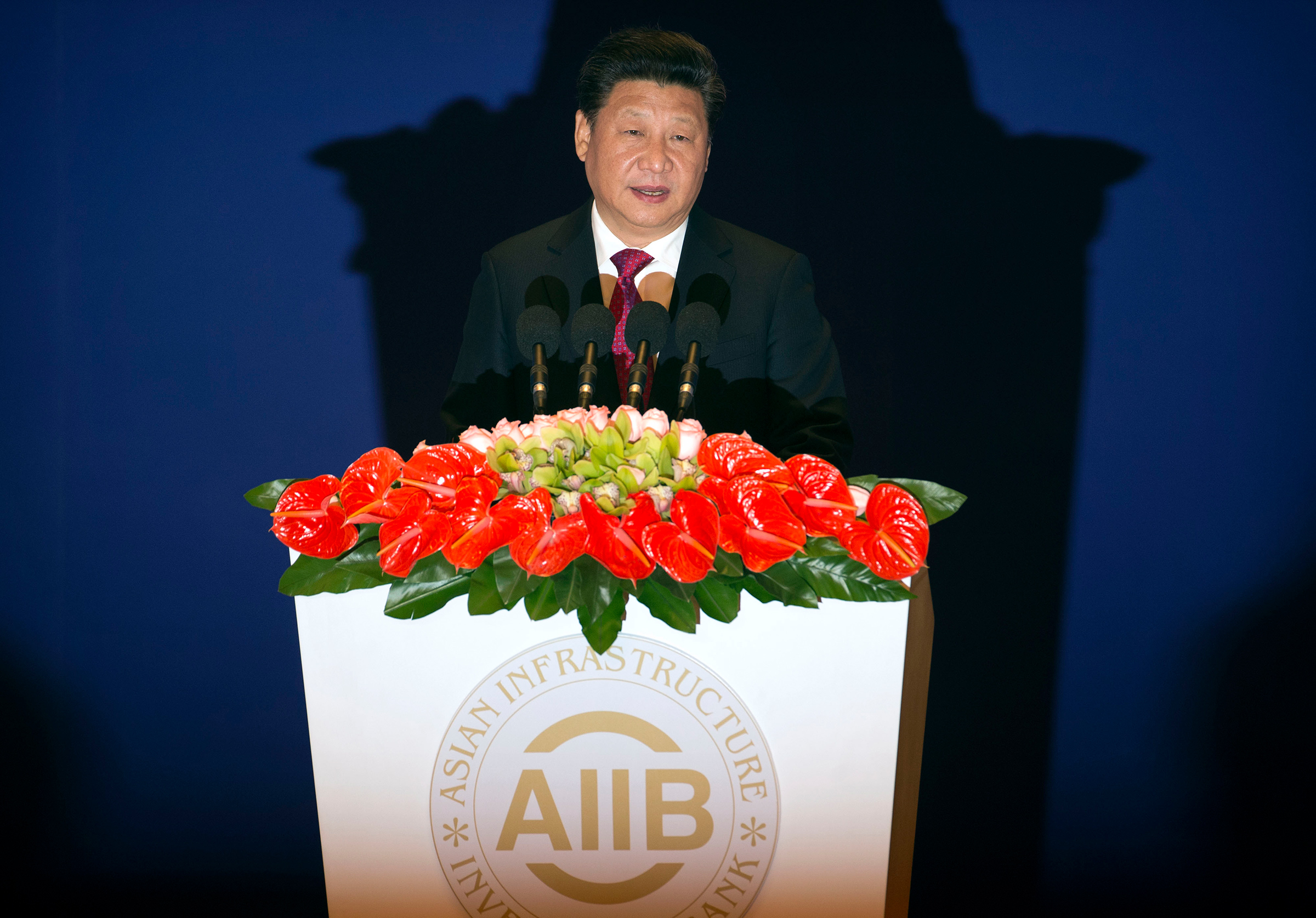

The multimillion dollar tourism project in Mandalika, spearheaded by the state-owned Indonesia Tourism Development Corporation (ITDC), has for years been mired in land disputes, allegations of state-sanctioned violence against local communities, and compensation schemes denounced as inadequate—problems that critics say its primary funder, the Asian Infrastructure Investment Bank (AIIB), which in 2021 committed to a nearly $250 million loan to the ITDC for infrastructural development in the aspiring tourism destination, has persistently turned a blind eye to.

With trouble brewing in Mandalika, the AIIB’s first financing of a tourism infrastructure development project anywhere in the world and its most scrutinized project to date, the China-founded multilateral development bank has found itself at a crossroads: having already been plagued with political skepticism surrounding its origins in Beijing, the perceived success or failure of the bank’s work in Mandalika could weigh heavily on its reputation. And beyond Mandalika, human rights advocates and experts are increasingly concerned about the project’s implications for ethical standards in global development financing going forward.

“How the AIIB implements its standards in this project—or not—will show what kind of bank it actually intends to become,” Wawa Wang, the director of Just Finance International, a nongovernmental organization that has been monitoring the Mandalika project, tells TIME. So far, she says, AIIB’s standards for consultation and rectification for social and environmental harm reflect “a very dangerous trend in a race to the lowest for all future projects.”

For its part, the AIIB has repeatedly stated that the Mandalika circuit, where many of the ongoing grievances have coalesced, is a separate project not directly funded by the bank. “AIIB’s project is a small component of a development project covering a much wider area,” Siva Jyosyula, senior social development specialist at the AIIB, tells TIME. “There is a misperception that AIIB is financing everything [in the Mandalika area], which was compounded by a gap in communication caused by the coronavirus pandemic, so we are working to let the public know what AIIB is funding and what [it] is not.”

“Everyone thinks that the whole project is driven by AIIB and the AIIB should address everything, which is actually not true.”

Rights experts have countered that the impact of the entire tourism project in Mandalika, including both the racetrack and the components financed by the AIIB, should be considered as a whole.

“Ultimately, the responsibility to respect human rights is one that needs to be seriously upheld by development finance institutions,” Pichamon Yeophantong, chairperson of the United Nations Working Group on Business and Human Rights, tells TIME. “They do have leverage … regardless of what they might like to say.”

Established in 2016, the AIIB was born out of Beijing’s frustration with sputtering efforts in Western-dominated multilateral development banks to give more say to developing countries and put greater emphasis on infrastructure financing.

On paper, it bore a familiar shape. Armed with the mantra “lean, clean and green,” the AIIB’s founding text featured social standards that were largely similar to its international counterparts, and it boasted a roster of leaders with decadeslong careers in institutions like the World Bank and the Philippines-based Asian Development Bank.

But skepticism swirled around the AIIB since its early days, with many seeing it as a proxy for the government of China, the bank’s largest shareholder, to boost its soft power. Such criticisms of multilateral development banks serving geo-economic interests may not be new—the World Bank is known for its enduring preference for American leaders, and the Asian Development Bank for the perceived outsized influence of Japan—but some argue that the AIIB has been subjected to greater suspicion from the West because of broader concerns about China’s growing geopolitical rivalry with the U.S.

“When it comes to the AIIB, it’s actually under much more scrutinization,” Jing Qian, a postgraduate research associate at Princeton University who studies multilateral development banks, tells TIME. “The simple fact that it’s initiated by China, and mainly founded by a group of emerging markets, has already put it under a much larger spotlight.”

Since the AIIB’s establishment, its founding member states have already borrowed significantly less from the World Bank for infrastructure projects, raising speculation that the AIIB could, Qian and his colleagues argue, “unsettle the political influence the United States has enjoyed over developing countries through its leadership of the World Bank.”

Last June, debate reignited over the bank’s independence after Bob Pickard, then the AIIB’s global communications chief and a Canadian national, decried in a public resignation that the institution was “dominated by Communist Party members” and had “one of the most toxic cultures imaginable.”

The AIIB, which denied Pickard’s claims, has spent years swatting away such talk. Jin Liqun, the bank’s president, told TIME in 2021 that the bank was focused on its work rather than politics. “The proof will be in the pudding,” he said.

But that pudding is now starting to leave a bad taste in many mouths. The public doubts that had plagued the AIIB since its early days are now joined by tangible results: a pattern of forced displacement has been reported at the AIIB-funded Bhola Integrated Power Plant in Bangladesh; the AIIB was criticized for investing $175 million in Cambodian microlending institutions known to engage in predatory and unethical practices; and the bank’s latest energy sector strategy, updated in 2022, has been slammed by civil society organizations for its uninclusive public consultation process and for falling short of a clear mandate to move away from fossil fuels. Meanwhile, the Mandalika project has drawn a rare level of international attention, with U.N. human rights experts issuing multiple statements of concern to Indonesian authorities and the AIIB.

With a final disbursement scheduled for this September, marking the end of the AIIB’s involvement in the Mandalika tourism project—and its ability to exert pressure over local authorities—final judgments on the totality of the bank’s work in Mandalika are starting to be made.

“December marks the fifth year of AIIB’s financing of the project, and yet Mandalika communities have endured and continue to face internal displacement, loss of livelihoods, and really the daily humiliation of project-induced poverty,” says Wang. “If we were to give the AIIB a scorecard through the lens of how project implementation performs against AIIB’s own environmental social standards, it is a fail.”

By some measures at least, the Mandalika development, set to become fully operational by 2045, is on track for success. By completion, the tourist destination is expected to generate about 30,000 jobs in the hotel industry and 60,000 jobs in other businesses. The province of Nusa Tenggara Barat, one of the poorest in the country, has also seen healthy economic growth in recent years, with its unemployment rate falling from 5.3% in 2013 to 2.8% in 2023.

All this stirs a positive outlook from the AIIB. “The results of what we’re doing and our catalytic investment, are already seen … We have new hotels that have come up, new economic activities that have come up,” says Siva. “And the focus and the drive, the support that the AIIB is providing to the government, is helping it to make it more sustainable as we move forward.”

Meanwhile, the AIIB has also found its footing in the global arena. In September, it received its largest-ever orderbook totaling over $4.8 billion for its Sustainable Development Bond. Jin, the bank’s president, lauded the news as a testament to the “broad confidence of investors” in the bank and its ambitions.

But as the once-budding bank has grown, so have expectations of its operating standards. While some of the AIIB’s early inadequacies to do with rights protection could be chalked off as “infancy problems,” such leniency in assessing the bank may soon be expiring, Katja Creutz, program director of the global security and governance research program at the Finnish Institute of International Affairs, tells TIME.

“Many commentators agree that the first five years, it’s sort of a work in progress,” Creutz says. “But I think we are moving now to the next phase of its operations where it’s supposed to not to be such a young bank anymore, but to really have matured into better governance, whether it concerns rights protection or other issues.”

To be sure, other multilateral development banks have also had their fair share of controversy. Projects funded by the World Bank were estimated to have displaced 3.4 million people, either physically or economically, in the decade leading up to 2015; as recently as November, the World Bank approved an investigation into one of its projects in Tanzania following allegations of state violence and evictions near its site. Meanwhile, in a rare admission of failure, the Asian Development Bank’s Compliance Review Panel lambasted the bank in 2014 for not ensuring the resettlement process for a railway project in Cambodia was properly implemented by Cambodian authorities.

“We are not saying the other development financial institutions are perfect, or are doing good enough at the job,” says Wang, but the AIIB “is repeatedly failing to meet its own and the most basic social environmental standards.”

The criticisms levied now at the AIIB over Mandalika may be taken in stride to help improve its future financing processes, say experts. “Incidents like this are providing a lot of opportunities for the leadership and for the staff in the bank to reflect and to do some internal examination and to make sure similar incidents do not happen, or at least happen as rarely as possible in the future,” Jianzhi Zhao, professor of international development and public policy at the University of Exeter, tells TIME. “It really depends on how the AIIB reacts and responds to things like this.”

So far, however, the AIIB’s record on introspection is mixed.

The AIIB said in 2021 that it had engaged an independent consultant to investigate allegations surrounding the land in Mandalika, which has long been characterized by rights disputes between residents and authorities. The resulting report “found no evidence of the alleged coercion [nor of] direct use of force and intimidation relating to land acquisition and resettlement.”

A resettlement action plan was also released in 2021 that stipulated compensation guidelines such as 10 million rupiah ($640) for each relocated household, half of which is meant to cover the down payment for a new home, and the provision of one job per household to account for the loss of livelihood.

AIIB representatives maintain that the bank is open to feedback from project-affected communities, who can reach out to local authorities or the bank’s grievance redress mechanism (a channel also found in other development banks to solicit concerns).

“The process of engagement and consultation is very much ongoing,” says Siva. “The AIIB is also interested in the overall development of the region. It is a catalytic development that we are trying to bring here. So these inputs that we get through these consultations, they’re useful in the further design of the project.”

But while the AIIB may be operating in good faith, the bank’s efforts have so far done little to alleviate the distress felt by those on the ground. According to a survey of Mandalika residents published last year by the Indonesian Coalition for Monitoring Infrastructure Development, 70% of respondents reported feeling coerced during the land acquisition process, while 79% said they experienced financial difficulties due to the Mandalika project.

Residents and rights advocates claim that recent visits by the AIIB have only proven its indifference about—or unwillingness to engage meaningfully with—aggrieved communities in Mandalika.

“I asked AIIB to take responsibility for a better life for the affected communities. But the AIIB didn’t dare, and didn’t want to,” Adi Wijaya, a resident of Ebunut, a once thriving hamlet that has been reduced to a fraction of its size as the racetrack cut squarely through it, told TIME in a video statement in December, days after a community meeting with AIIB representatives.

“The community is not anti-development,” Harry Sandy Ame of local legal assistance group Nusa Tenggara Barat Institute for Study and Legal Aid, which had helped to organize the meeting, tells TIME. “They [have] not rejected the development. They only want to be recognized about their existence and livelihood … which is now diminished and lost by this project.”

The AIIB insists that it has made every effort to engage but also points to the sheer scale of the Mandalika project as a mitigating factor. “It’s not logistically feasible to meet all the local people,” Sangmoo Kim, a senior investment operations specialist at the AIIB who was on the site visits, tells TIME, adding that they met “well over 100 people” during the three-week visit spanning different parts of the project area.

“The project is quite complex, and also sensitive in different ways. And for that reason, there are different views and interests and issues,” he says. “But I could say based on my multiple missions in the project site, in general the local communities are quite happy and supportive for this long awaited Mandalika tourism development.”

Still, advocates insist that further scrutiny is warranted of the human impacts of the AIIB’s investments, not just its topline numbers reflecting economic development. “It’s the only way to remember that they are not only projects on paper,” says Creutz, the global security and governance researcher, “but they affect people’s lives—people in the field, on the ground.”

https://time.com/6590390/mandalika-indonesia-aiib-development-concerns/

Comments

0 comment